Detects tone of Fed messaging from easy to restrictive - to inform trades

At a Glance

- JPMorgan Chase has unveiled an AI model that seeks to decipher famously ambiguous Fed messaging.

- Model will rate Fed’s tone from easy (dovish) to restrictive (hawkish), providing potential tradeable signals.

- The score is available for European Central Bank and Bank of England, with plans to expand to more than 30 central banks.

JPMorgan Chase has unveiled an AI model designed to interpret the famously ambiguous messaging from Federal Reserve, as the central bank heads into its May meeting next week.

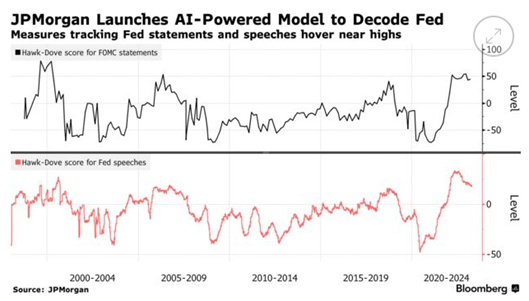

The model was built using data from Fed statements and central banker speeches going back 25 years, according to Bloomberg. A language model is then used to decipher the tone of policy signals and then rate them on a scale. The scale of tone ranges from easy (dovish) to restrictive (hawkish) in what it calls the Hawk-Dove Score.

JPMorgan’s economists – including global economist Joseph Lupton − found that the AI model can be used to predict the possible direction of monetary policy and, in turn, provide potential tradeable signals.

For example, they found that when the model detected a rise in hawkishness from Fed speakers between Federal Open Market Committee (FOMC) meetings, the next monetary policy statement was also more hawkish – and yields on 1-year Treasury bills went up.

“Preliminary applications are encouraging,” Lupton and his colleagues wrote in a note announcing the AI model.

The Hawk-Dove Score is also applicable to other entities, including the Bank of England and the European Central Bank, with plans to expand it further later this year.

The AI model comes after at least two papers were published this month about using ChatGPT to decipher the Fed and forecast stock prices.

Don’t expect Fed to cut rates, for now

Heading into the Fed’s next meeting on May 2 to 3, the score ranks the central bank as remaining hawkish, with this sentiment hovering near the highest levels in two decades, according to Bloomberg.

The Fed is expected to raise the target for the Fed Funds Rate by 0.25 to 5.25%, according to the median forecast of economists surveyed by Bloomberg.

A 10-point rise in the Hawk-Dove Score would translate to a 10-percentage point increase in the likelihood that the Fed would raise rates by 25 basis points next week.

Last year’s spate of interest rates increases have helped fuel a rare selloff in both stocks and bonds, which normally are decoupled. It also led to accusations that the hikes contributed to the regional banking crisis. Bond traders have been betting on the Fed to cut rates later in 2023.

Read more about:

ChatGPT / Generative AIAbout the Author(s)

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)