AI Startup Roundup: Fintech Trading Platform Raises $270M

Also, startups in market intelligence, NLP, logistics and online learning

Every week, AI Business brings you the latest startup news.

From funding rounds to acquisitions, product launches to partnerships, AI Business covers everything artificial intelligence.

To keep up to date with coverage of all things AI, subscribe to the AI Business newsletter to get content straight to your inbox and follow the AI Business Podcast on Apple and Spotify.

Funding news

Clear Street

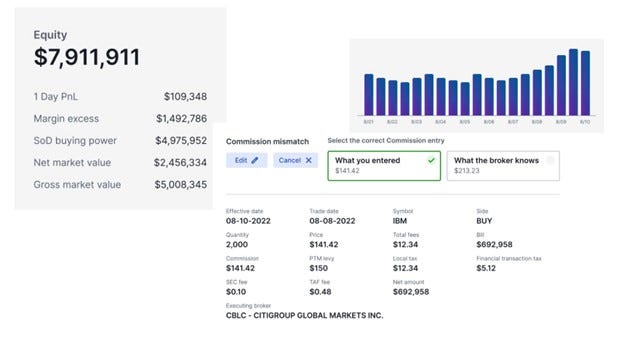

A New York-based fintech, Clear Street builds trading infrastructure for clearing, custody and execution of trades and prime brokerage services. Its cloud-native platform is designed to replace legacy capital markets systems to improve speed and access for clients.

The investment is the second tranche of a $435 million series B funding. Among earlier series B investors are Prysm Capital, NextGen Venture Partners and Xendit founder and CEO Moses Lo.

Latest funding: $270 Million, series B

Lead investor: Prysm Capital

Funding plans: Clear Street said the newly secured funds will be used to expand into new markets and asset classes, as well as accelerate future product offerings and increase availability.

AlphaSense

Based in New York, AlphaSense offers an AI-powered market intelligence and search platform to help businesses make informed decisions.

Designed for B2B clients, its platform utilizes AI and language models to extract insights from public and private data, including equity research, earnings calls and trade journals.

Latest funding: $100 million, series D extension ($225 million raised last June)

Lead investors: Goldman Sachs Asset Management, Viking Global Investors

Other investors: CapitalG, Alphabet's independent growth fund

Funding plans: The investment will fuel the deployment of AlphaSense's platform including its generative AI capabilities.

LMS365

Based in Denmark, LMS365 offers an online learning management system to automate and track instructor-led training on Microsoft products.

The company’s platform is integrated into Microsoft’s 365 suite, including the Viva employee experience platform.

The startup announced last month that it will be integrating its tech with LinkedIn Learning. Users will be able to find LinkedIn Learning training content from LMS365’s learning platform.

Latest funding: $8.7 million, series A

Lead investor: Blue Cloud Ventures

Other investors: Kamet Capital Partners

Funding plans: The newly raised funds will go towards the company’s expansion, having already entered markets in the U.S. and Australia.

Frayt

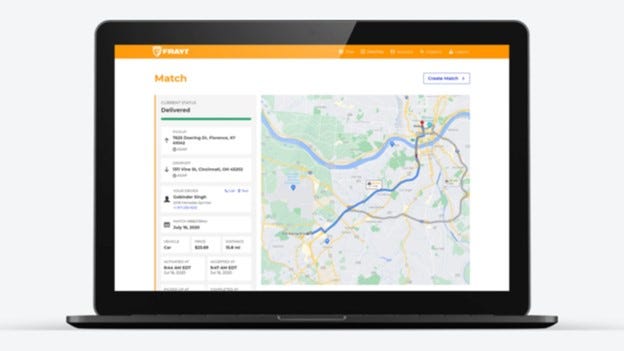

Frayt is a Cincinnati, Ohio startup behind an AI-powered logistics and delivery platform. Customers in industries such as retail, building material supply and manufacturing are using Frayt as their last-mile, on-demand delivery solution.

Users can track orders and use the company’s API to integrate with existing logistics solutions to power scalable on-demand delivery needs.

Latest funding: $7 million, series A

Lead investor: Refinery Ventures

Other investors: The JobsOhio Growth Capital Fund, Capital Midwest, Venture 53

Funding plans: Frayt wants to expand into new markets and plans to use the cash to grow its team and support product innovation.

Xapien

Xapien uses AI and natural language processing to generate reports that power decision-making.

The company describes its tool as “the ChatGPT of due diligence,” capable of generating reports for client onboarding, reputational and integrity due diligence as well as donor prospect research.

Latest funding: $5.5 million, seed funding

Lead investor: YFM Equity Partners

Other investors: D2

Funding plans: Xapien wants to expand into new verticals and extend its U.S. footprint.

SwitchOn

Based in Bengaluru, India, SwitchOn offers edge AI tech for defect detection in manufacturing settings. The startup claims its platform requires just 200 images to train its AI models so manufacturers can automate quality inspection processes at speed.

Latest funding: $4.2 Million, series A

Lead investor: Pi Ventures

Other investors: The Chennai Angels, Axilor Ventures

Funding plans: SwitchOn is looking to expand in its native India and beyond, as well as invest in R&D to improve its solution.

Financing news

SoundHound AI, a Santa Clara, California-based startup that develops AI-powered speech and audio recognition services, has closed a new $125 million loan facility, from Atlas Credit Partners.

The new credit line, with $100 million made available at closing, replaces $30 million of current debt with a “more favorable” structure that reduces cash outflows and extends maturity to 2027.

After deducting closing costs and repaying existing debt, SoundHound is expected to have over $100 million in cash. The credit agreement also lets the company tap another $25 million.

The lending facility will enable SoundHound to accelerate market expansion. The company offers AI-based voice recognition customer service products for restaurants, device manufacturers, automakers and others.

About the Author(s)

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)