Server Sales to Fall for the First Time in 15 years

Enterprise buyers, hyperscalers pivot to servers with AI co-processors

At a Glance

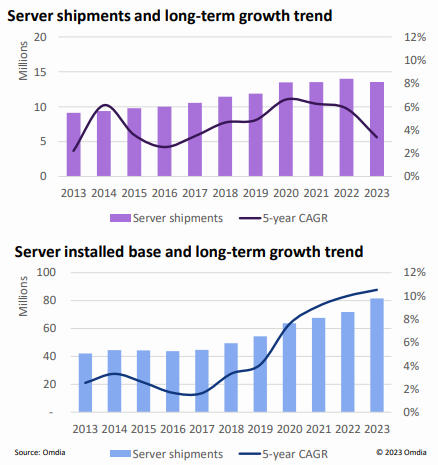

- Shipments of general purpose servers are expected to decline for the first time in 2023 since the financial crisis.

- Enterprise buyers and hyperscalers are pivoting to servers with AI co-processors as new computing platform emerges.

Enterprise server shipments are expected to decline this year for the first time since the 2007-2008 financial crisis, according to a new report by sister research firm Omdia.

While macroeconomic factors played a part, the decline mainly signals a change in priorities for both enterprises and large cloud service providers toward preparing for the intense compute requirements of AI models, according to the report, "Cloud and Data Center Market Update."

“The fear of missing a wave of market opportunity fueled by the rapid adoption of ChatGPT is driving both cloud service providers and enterprises to amp up AI model training,” the analysts wrote.

Server buyers are delaying updates to existing general purpose servers as they invest in the “significant” outlay for AI servers, analysts said.

In the first quarter of 2023, 2.8 million servers were sold, which was “significantly” below the typical seasonal trend, the analysts said. Indeed, the decline in server shipments from the fourth quarter of 2022 to the first quarter of this year was the largest on record.

Omdia is forecasting a 12% decline in server shipments for 2023.

Meanwhile, the market share of servers configured with AI co-processors is rising. “AI applications like ChatGPT have gained unprecedented traction and fueled a new investment wave,” said Omdia Research Director Vladimir Galabov. “In conversations with Omdia, colocation providers and physical infrastructure vendors indicate strong and even record demand for their solutions.”

There was "strong" demand for servers from Microsoft, Google and Meta in the first quarter, according to Omdia. Some of this could stem from their focus on building AI applications such as Copilot, Bard and I-JEPA, respectively.

AWS, however, has pulled back on new server installations. For the second quarter, Omdia is forecasting "austerity" at both AWS and Meta.

Compute demand still rising

The demand for compute is still increasing, even if it is not reflected in the server shipment forecast because companies are buying second-hand servers or using their existing servers longer.

Omdia's analysis shows that the average useful life of a server is now 6.2 years, up from as low as 4.1 years a decade ago. Second-tier European cloud providers have even reported using their servers for nine or even 10 years.

European cloud providers said the pandemic had boosted the purchase of second-hand servers as a way to cope with the chip shortage. But second hand servers remain popular today due to the high cost of capital and credit constraints.

After 2023, Omdia analysts see server shipments accelerating, with new CPUs by AMD, Intel and Arm enabling "significantly denser and potentially lower power compute architectures, enabling significant power savings and space savings at a time of high electricity costs and strong NIMBY (not in my back yard) sentiment."

As for investments in data centers, they remain "healthy" with vendors and colocation services providers reporting "strong demand" overall. Capital expenditures in 2023 by the hyperscalers remain high: AWS at $32 billion and Meta, Google and Microsoft each at $22.5 billion.

Hyperscalers, though, are shifting their priorities toward building highly configured server clusters to train AI models in “a rush to respond to pent-up consumer and enterprise demand for AI," the analysts said. They note that the build out of data centers continues to grow at a 10% clip in size every year.

About the Author(s)

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)