Nvidia CEO: AI Activity has 'Accelerated Significantly'

After reporting blow-out earnings, CEO Jensen Huang added $9.6 billion to his fortune in one day, making him the 21st richest person in the world.

At a Glance

- Nvidia reported record revenue and earnings for the fourth quarter, propelling its shares up 8.4% in after-hours trading.

- Nvidia CEO Jensen Huang announced Nvidia AI as a service, which will be hosted by major cloud providers.

Updated with new stock price, analysts' comments and charts.

Nvidia, maker of the most widely used advanced AI chips, reported a 265% increase in fourth quarter revenue from a year ago - a sign that the AI boom is not letting up.

“Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations,” said Jensen Huang, founder and CEO of Nvidia, in a statement.

Nvidia reported $22.1 billion of revenue for the quarter and $60.9 billion for the full year, up 126%. Net income soared 769% to $12.3 billion for the quarter ($4.93 per diluted share). For the year, net income was up 581% to $29.8 billion ($11.93).

Nvidia beat Wall Street analysts' expectations on both revenue and earnings. Shares of Nvidia soared by 16.4% to $785.38, adding $277 billion to its market value in one day. That is the single biggest increase in a session in stock market history, according to Bloomberg.

The company is now valued at $1.94 trillion, easily passing Google ($1.8 trillion) and Amazon ($1.81 trillion). Nvidia is only behind Apple (2.85 trillion) and Microsoft ($3.06 trillion) as among the most valuable companies in the U.S.

The stock climb also added $9.6 billion to Huang's fortune, making him the 21st richest person in the world, based on the Bloomberg Billionaires Index. He is now just behind the Walton family of Walmart fame.

Based on Nvidia's quarterly performance, BofA Global Research analysts raised their price target to $925 for Nvidia's stock, from $800. "Perhaps the most important new data point in Nvidia's earnings call was that AI inference contributed nearly 40% of AI computing mix," they wrote in a note to clients. "AI inference is correlated with revenue bearing AI which is supposed to be more competitive, as opposed to AI training which Nvidia already dominates."

Nvidia AI as a service

Nvidia invented the graphics processing unit, or GPU, in 1999 for faster rendering in gaming. Later, the GPU became ideal for the intense computations needed in AI and Nvidia's chips saw such strong demand that there remains a shortage of these semiconductors. Nvidia commands over 80% of the advanced AI chip market.

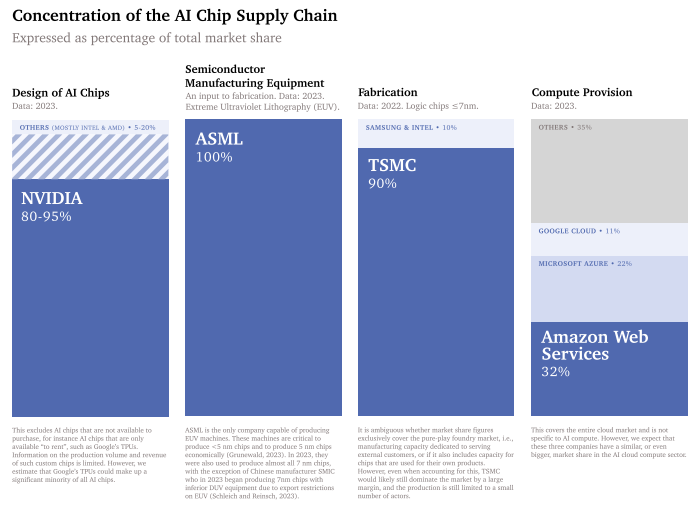

Credit: The February 2024 paper, 'Computing Power and the Governance of Artificial Intelligence'

On the call with analysts to discuss earnings, Huang announced Nvidia AI as a service, an AI platform hosted by the large hyperscalers. Through the service, clients can access Nvidia's AI supercomputer, DGX, tap its acceleration library software or use pre-trained AI models.

Huang said DGX can be accessed through a web browser. The Nvidia DGX Cloud is currently available through Oracle Cloud, Microsoft Azure and Google Cloud, with others coming.

"Enterprises in just about every industry are activating to apply generative AI to reimagine their products and businesses. The level of activity around AI, which was already high, has accelerated significantly," Huang said. "This is the moment we've been working toward for over a decade. And we are ready."

Read more about:

ChatGPT / Generative AIAbout the Author(s)

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=700&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.jpg?width=300&auto=webp&quality=80&disable=upscale)